Process optimization through integration of key systems of a client from the leasing industry

A project in a nutshell

The core business of the client was the financing of a wide range of items, ranging from passenger cars and trucks to office equipment and production halls. The value of these items often reached millions and they were handled by a highly specialized team. Financing was provided under leasing or loan agreements, whereas insurance was previously outsourced to external companies.

As a result of business decisions, the client resolved to entrust insurance services to a dedicated internal company. Our company, with many years of experience in the insurance market, was selected to provide a system that would primarily integrate various solutions, automate processes, meet sales and reporting requirements and also make it possible to present an insurance offer already at the stage of initial talks with a customer.

INDUSTRY

Insurance

PRODUCT

VSoft Insurance Platform

SERVICES

- Analysis of leasing, insurance, reporting and other processes in the organization

- Implementation of appropriate integrations and optimization of the data flow.

Our client

Our client is one of the leading leasing institutions in Poland. It has been operating in the market for more than 25 years. It offers financing in the form of leasing and loans, supporting enterprises of all sizes – from small and medium-sized companies to the largest companies in the market. The financing covers vehicles, IT hardware, machines, equipment and investments. In response to market needs and the development of its leasing business, the company has expanded its offering to include motor and property insurance, ensuring better asset protection and providing comprehensive support to its clients.

Challenges

Longer lead time in connection with the preparation of the offer by an external company.

No impact on policy coverage and limited possibilities of upselling products.

High insurance handling costs and minimal profit from policy sales.

Lack of an internal insurance agency and a suboptimal flow of data.

How did we help our client?

Key stages of the project

01

Concept of functionality

Development of a detailed concept of the system, taking into account the needs of the client, key functionalities and future development opportunities.

02

Business scenarios

Preparation of key business scenarios, from the sale of an item to the conclusion of an insurance agreement.

03

System integration

Integration of the insurance system with the existing leasing system which had been supporting the financing agreements.

04

New functions

Introduction of a function generating offers and recalculations, as well as issuing policies and operations directly from the leasing system.

05

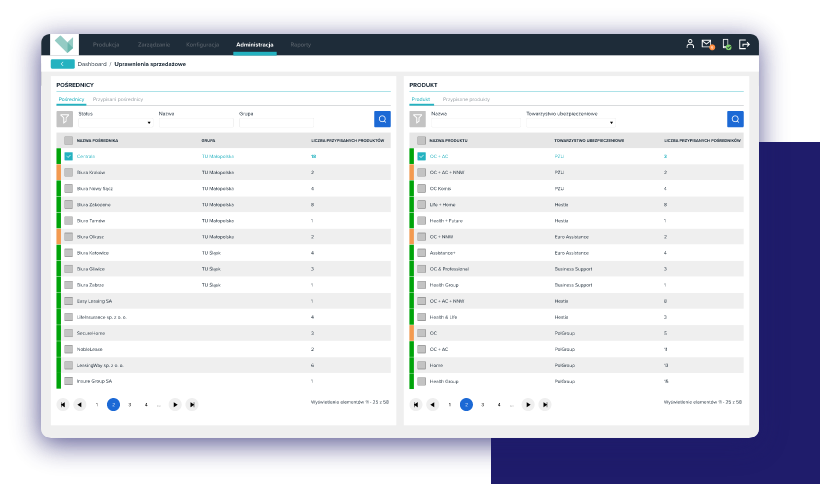

Extended integration

Integration with additional systems of the client, such as the archive of documents, eBOK and the reporting system.

Solution

As part of conceptual work, we prepared intelligible diagrams both for the topic-specific teams and the technical teams, which made it easier for everyone to understand the project. A detailed plan was created and divided into stages.

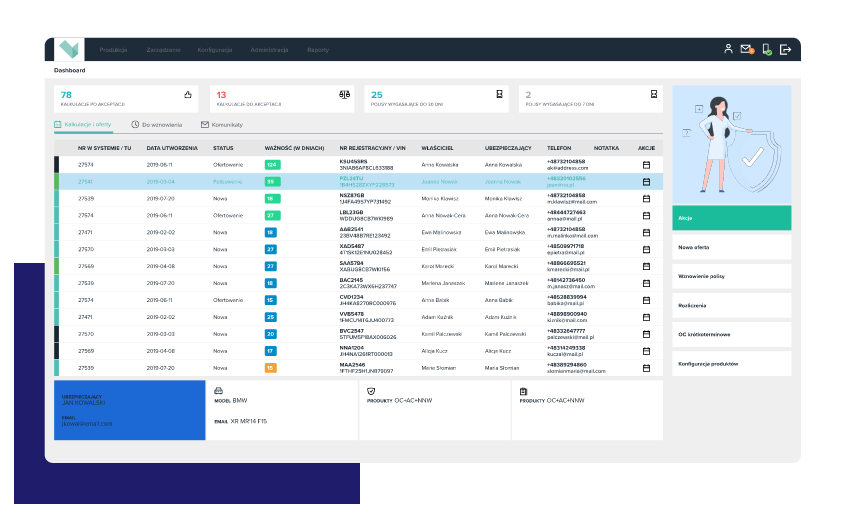

Using an API, we developed methods that made it possible to perform an integration with a leasing system, eliminating the need to manually enter data for calculations. When data were supplemented in the leasing system, it automatically generated calculations in the insurance system. We also made it possible to have policies issued directly from the leasing system, minimizing manual entry of data by employees of the insurance agency

The next stages of the project included integration of the insurance system with other customer systems, which improved the quality of data and ensured its automatic flow, e.g. after issue or settlement of a policy.

Thanks to the reporting system, data were presented on dashboards on an ongoing basis and insurance proposals – both for new policies and renewals – were automatically sent to the customer portal.

What results has the client achieved?

Check the most important benefits resulting from the implementation

Process automation

Automatic generation of offers and automatic issue of policies has significantly reduced customer service time and eased workloads for employees of the insurance agency.

Better access to data

Integration with the archive of documents and with the central repository has provided a full insight into the documentation of customers.

Increased sales efficiency

Thanks to integration with the reporting system and eBOK, sales results were monitored on a continuous basis and offers reached customers faster, which has increased sales and improved the quality of service.

Key conclusions

Integration of systems improves the quality of data and eliminates errors.

Automation reduces workload of employees and boosts efficiency.

Integrated systems strengthen the operational coherence of the organization.

Faster exchange of data speeds up customer service and increases the efficiency of sales.

Advanced data analysis facilitates preparation of personalized offers.

Additional materials

Blog

InsurTech: Key criteria for selecting a system and a technological partner

The InsurTech sector supports the way insurance companies operate, both at the level of product creation and product distribution. Modern solutions can significantly improve operational efficiency and user experience. Choosing the right technology partner is essential for achieving success in this area. Below, we provide an overview of important criteria that are worth considering when deciding to implement InsurTech solutions in your company.

Blog

Expand insurance market: How to transform an insurance multi-agency into an industry leader?

For an insurance multiagency to succeed in a competitive market, implementing intuitive digital solutions is key. Users expect easy access to information, fast performance and an attractive interface. This article looks at how to build effective systems that not only improve customer service, but also allow full integration with other tools.

Blog

Digitization in insurance: technological race or a real business-changing value?

Digitalization and new technologies have become a central topic in the insurance industry. Technological progress and growing customer expectations force companies to implement modern digital solutions. During each industry conference, experts, market leaders and innovators discuss their potential, looking for solutions to secure the future of the insurance sector.

Case study

Standardization and optimization of the sales process in a leasing company

The standardization and optimization of the sales process in a leasing company eliminated manual data entry and reduced the time required to prepare offers. Automation enabled one-time data entry, automatic comparison of insurance offers, and the sale of additional products with a single click. The system streamlined premium calculations, policy issuance, and reporting. See how the implementation improved efficiency and increased sales.

Write to us

Are you interested in our experience in the insurance industry? We’d love to tell you more about our technologies! Complete the form and we will get in touch with you.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.