Standardization and optimization of the sales process in a leasing company

A project in a nutshell

The dynamic growth of the client’s business and the continuous expansion of the product range, including insurance products, extended the process of issuing policies. More and more customers indicated that they were interested in offers from competitor insurance companies and did not always opt for insurance proposed in addition to leasing. At the same time, the growing number of products complicated the post-sale service, especially the settlement of policies.

The use of multiple systems proved to be an additional burden for the team, making it necessary for employees to perform time-consuming manual operations instead of optimizing offers and actively acquiring customers. The number of systems to handle insurance products, had a significant impact on the company’s growth.

Starting to work with a client, we implemented functionalities in stages, assuming that visible effects would be achieved after the first phase. We analysed the daily work of users, the number of calculations, offers and customers served, as well as the time spent on processing inquiries in order to identify areas to be optimized.

INDUSTRY

Insurance

PRODUCT

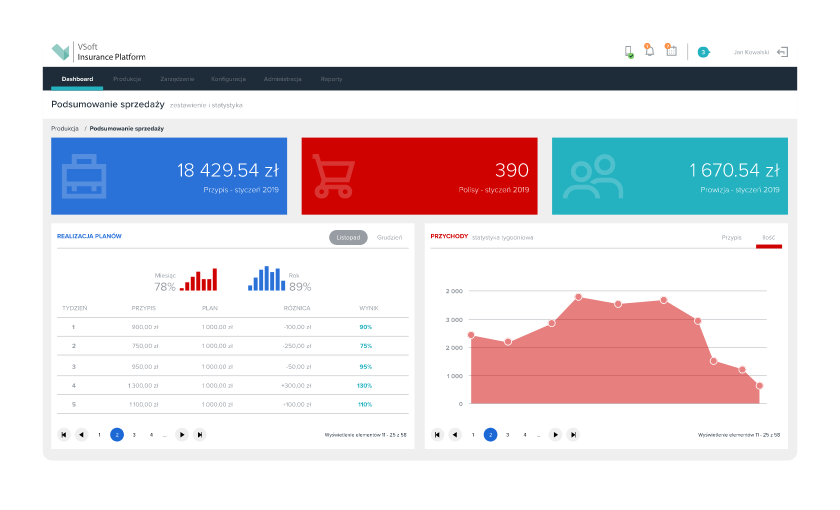

VSoft Insurance Platform

SERVICES

- Analysis of leasing, insurance, reporting and other processes in the organization

- Implementation of appropriate integrations and optimization of the data flow.

Our client

Our client is one of the leading leasing institutions in Poland. It has been operating continuously for over 25 years. It specializes in providing financing in the form of leasing and loans, supporting the development of enterprises all over the country. The financing covers, among other things, vehicles, IT hardware, machines, equipment and investment projects. Its services are used by both small and medium-sized companies and the largest companies in the Polish market. With the development of its offer, the company expanded its operations to include motor and property insurance, in response to the needs of its customers.

Challenges

Time-consuming manual preparation of offers in various calculators and systems of the insurance company.

Low quality of data due to manual entry of the same information in different systems.

Difficulties with comparing insurance offers from different insurance companies due to manual preparation of summaries of parameters.

Necessity to update offers in many systems after changes made by a customer or after entry of new data.

Generation of offers for additional products required further calculations in different systems.

How did we help our client?

Key elements of the project

01

Designing calculation of the premium

A process was developed so that premiums could be calculated for many products in a single operation.

02

Data entry

Data are entered only once and the system automatically sends them to all cooperating insurance companies.

03

Edition of parameters

Changes in the calculation parameters and details of the object, subject and scope of insurance are entered in one place and automatically update all offers.

04

One-click sales

Additional products can be sold without it being necessary to re-enter data, which significantly shortens the service time.

05

Automatic summaries

The system automatically generates summaries of offers based on the collected data, eliminating the need to compare parameters manually.

06

Issue of multiple policies

It has been made possible to issue several policies simultaneously with one click, which simplifies the sales process.

07

Automatic reports of the insurance company

The system creates reports tailored to the requirements of particular insurance companies in a fully automatic manner.

08

Centralized settlements

All policies are settled in one place, with verification of the correctness of calculation of premiums and commissions.

06

Wystawianie wielu polis

Solution

Based on conducted analyses and meetings, we have developed a system which automates the process of calculating premiums, selling insurance products and issuing policies. With one-time entry of data, which are automatically sent to all cooperating insurance companies, it is possible to generate offers and issue many policies with one click, and to automatically create reports and settlements, which streamlines processes significantly and brings savings of time.

What results has the client achieved?

Check the most important benefits resulting from the implementation

Improvement of the quality of data

The automation of the calculation process has eliminated erroneous data, providing a guarantee of data correctness and quality.

Simplification of calculations

The time of preparing a list of 10 products has been shortened to a minute, making it possible to sell additional products with one click.

Standardization of settlements

A universal process of settling premiums has been introduced, eliminating errors and automating the generation of reports.

Process automation

Automation has enabled employees to focus on negotiations and customer service, improving the quality of services and increasing the number of policy renewals.

Key conclusions

It is essential to carry out an in-depth analysis and provide workshops for users.

A holistic approach must be adopted, taking into account not only the system but the entire organizational context.

Observation and curiosity help to break away from established patterns and to overcome resistance to change.

Automation of repetitive tasks results in a significant increase in efficiency.

Additional materials

Blog

InsurTech: Key criteria for selecting a system and a technological partner

The InsurTech sector supports the way insurance companies operate, both at the level of product creation and product distribution. Modern solutions can significantly improve operational efficiency and user experience. Choosing the right technology partner is essential for achieving success in this area. Below, we provide an overview of important criteria that are worth considering when deciding to implement InsurTech solutions in your company.

Blog

Expand insurance market: How to transform an insurance multi-agency into an industry leader?

For an insurance multiagency to succeed in a competitive market, implementing intuitive digital solutions is key. Users expect easy access to information, fast performance and an attractive interface. This article looks at how to build effective systems that not only improve customer service, but also allow full integration with other tools.

Blog

Digitization in insurance: technological race or a real business-changing value?

Digitalization and new technologies have become a central topic in the insurance industry. Technological progress and growing customer expectations force companies to implement modern digital solutions. During each industry conference, experts, market leaders and innovators discuss their potential, looking for solutions to secure the future of the insurance sector.

Case study

Process optimization through integration of key systems of a client from the leasing industry

The integration of the leasing client’s key systems enabled the automation of processes, eliminating manual data entry and reducing customer service time. This gave the client full control over quotes and increased the efficiency of policy sales. The integration of systems improved data flow, reduced the risk of errors and lowered operational costs. Read how the implementation influenced process optimisation and the results achieved.

Write to us

Are you interested in our experience in the insurance industry? We’d love to tell you more about our technologies! Complete the form and we will get in touch with you.